July 2022 saw the lowest ad revenue in two years and a double-digit decline from levels a year ago. Rising inflation, concerns about the economy, and worries about an economic recession are taking a toll on spending.

There’s been political debate about whether the current economic environment qualifies as a recession, but seven out of 10 consumers believe we are already in one.

Besides spending, there are other warning signs that publisher revenue is likely to continue to decline as the latest ad revenue report rolls out. According to an Advertiser Perception report, 20% of marketers are reducing their ad spending as some of the biggest advertisers move ad dollars to improve customer experience instead.

Publishers can’t afford to wait to take proactive measures.

The ad industry also continues to contract. In May 2022 alone, major ad agencies eliminated 2,400 jobs in the US.

Even if these downturns haven’t hit publishers yet, we appear headed for some challenging times. Publishers can’t afford to wait to take proactive measures to protect revenue.

Q3 & Q4 Uncertainty Leads to 2023 Cutbacks in Spending

Revenue Continuity is a big topic right now. One industry veteran we talked to said he’s telling publishers to grab the dollars they can in Q3 and Q4 of 2022 because the ad revenue forecast for 2023 is up in the air right now and could see significant cutbacks.

The headlines tell the story:

- Axios: Media and tech sectors brace for ad market slowdown

- The Hollywood Reporter: Global Advertising Forecast Cut to 9.2 Percent Amid Economic Slowdown

- Business Insider: Advertising cuts are coming amid spending downturn

- Luma Partners: InsideRadio — The ad tech buying wave has slowed in 2022

- WARC: Ad spend to slow significantly in 2023

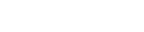

2022 ad revenue is not tracking even close to the previous two year cycle, according to the Ezoic Online Ad Revenue Index:

Despite heavy spending in Q1 2022, digital ads are now back down to spending levels in 2018, well before the pandemic hit. Publishers should brace for a potentially rough 4th quarter in 2022 and be extremely careful about their budget forecasts for 2023 as brands pull back on budgets, expecting lean times.

Expanding Competition

Besides cutbacks in ad budgets, publishers are also facing expanded competition for ad dollars. The astonishing growth rate of in-house retail media networks from major brands such as Walmart, Target, Kroger, Best Buy, Home Depot, Macy’s, and others is drawing ad dollars away from publishers.

After two years of ad buying on retail media growing by more than 50%, it’s forecast to end 2022 with a 31.7% uptick, accounting for $1.3 billion in spending. Despite declining forecasts for many sectors in 2023, retail media projects a 26.2% growth rate to $52.2 billion.

Announcements that Netflix and other streaming providers are entering the advertising competition won’t help publishers either. These streaming services and retail media ad networks also have access to mass amounts of first-party data, often at the point-of-purchase level, which is making them attractive alternatives for advertisers.

In 2023, we expect to see Google finally pull the plug on third-party cookies in its Chrome browser. Safari, Firefox, Brave, and others have already done so. Ad blockers also continue to play a significant role in taking chunks of revenue away from publishers, adding up to more than $30 billion in lost revenue annually.

Focus on Revenue Continuity in 2022 could Avoid Layoffs in 2023

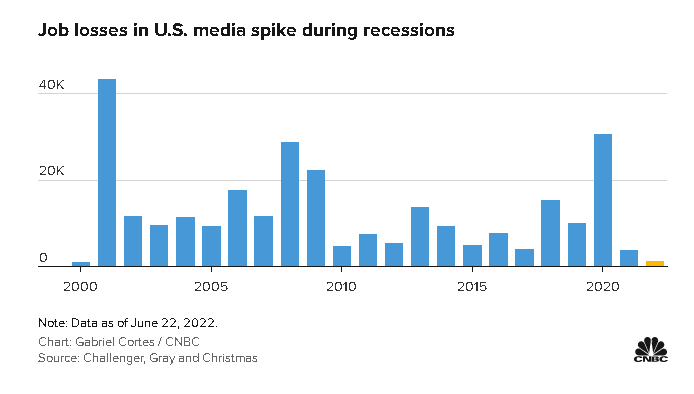

Not only are ad revenue and budget forecasts uncertain, but there have been numerous stories of layoffs in the media publishing industry, and concerns that 2023 may bring more.

Publishers that act now to quickly grow subscriptions, or donations, or recover 10-40% of adblocked revenue, could potentially save some key staff to thrive while the competition retracts.

Here are some of the recent reports of layoffs in the industry:

- Callisto Media lays off 35% of the workforce - Publishers Weekly

- Recession could send media layoffs surging - Variety

- Outside Interactive media company lays off 85-90 staff - Poynter

- Gannet lays off at least 80 staff amidst losses - Deadline

- Hiring freezes at Meta, Twitter, and more - Fortune

- Vox Media lays off 39 amid economic uncertainty - Axios

Job losses have been historically low, likely due to the huge spike during COVID in 2020. However, there is a relationship between media job losses and economic recessions, should the economy worsen. See the below media job loss data from CNBC:

Act Now to Protect Ad Revenue

To prepare for the confluence of all of these things, publishers need to take steps now to optimize their monetization efforts. One of the easiest things you can do is to employ an adblock recovery strategy to recapture lost revenue.

There is typically a segment of adblock users ready and willing to turn off their adblockers if you just ask. You've already earned their visit and built your ad stack, now maximize it for Q4, ahead of an uncertain Q1 economy.

Factinate was able to quickly increase their recovered pageviews and reduce their ads blocked rate with Admiral's Revenue Recovery approach.

Factinate

Factinate is a general knowledge website with active content producers. By adding Admiral as an adblock recovery solution, they saw their adblock rate decline by nearly 69% while recovering 44% of the revenue they had been losing to adblockers.

(Adblock revenue recovery case study)

Diversify your Revenue Across Channels and Visitor Segments

Visitors have diverse goals and wants, and they engage at their own pace. If you are not offering multiple ways for them to support your site, you could be missing out on your maximum average revenue per visitor (ARPV).

You will never have 100% subscribers, or 100% newsletter signups, or social media follows, or adblock whitelist, etc. But you CAN have 100% coverage and revenue diversification with a single platform like Admiral's Visitor Relationship Management (VRM) software.

Admiral makes this easy by combining marketing automation, an AI and journey builder, and an engagement layer that is present at every visitor touchpoint.

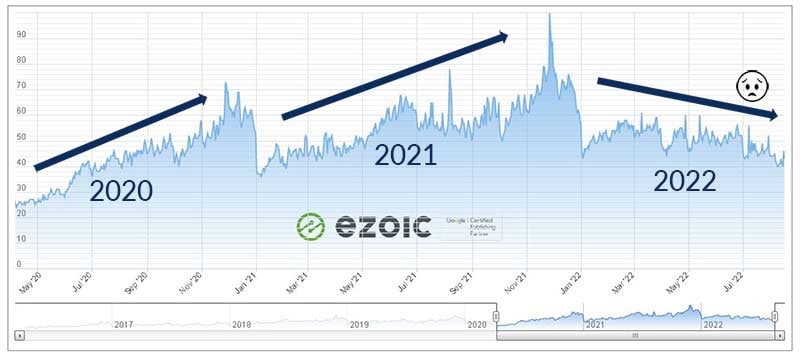

See below how both Mediaite and Enyclopaedia Britannica built multiple revenue opportunities, including subscriptions, donation campaigns, and adblock recovery:

Mediaite

Mediaite is a national news website that focuses on media and politics. By adding a JS tag to their site’s headers and using Admiral’s Visitor Relationship Management (VRM) platform, they were able to recover 52% of their lost revenue due to ad blockers.

At the same time, the VRM tested multiple offers and pricing for paid subscriptions. As a result, new subscription rates grew 3.7 times the amount of recovered ad revenue.

(Paid subscription case study)

Encyclopedia Britannica

Encyclopedia Britannica deployed Admiral’s Engage-based adblock revenue recovery module after having a poor experience with another solution. By offering subscriptions, memberships, and donations, the improved revenue recovery by 80%.

A "Swiss Army Knife" for Revenue

Even large publishers have already begun layoffs in 2022. Ad spend is often lagging other economic factors, and although most of Q4 may be locked in for the season, a dramatic pullback in Q1 could materialize.

Publishers should be optimizing all current channels, and launching offers in new ones, to best prepare for revenue continuity. In some cases, this may even save jobs and companies.

Admiral VRM is a proven "Swiss Army Knife" for revenue generation and visitor retention. Consider these benefits of leveraging a VRM approach today:

- Recover full-stack revenue from millions of blocked pageviews

- Grow email newsletter signups & revenue

- Grow paid subscriptions or test a donation campaign

- Offer ad-free subscriptions to visitors as an alternative to allowlisting

- Grow app revenue or social media follows

- Start a registration wall to authenticate users and grow first-party data.

Every engagement provides more data and insight into your visitors, increasing their value and your ability to offer the next step in their journey.

It’s Time to Act

With a potential decrease in online advertising spending anticipated for 2023, publishers should immediately take proactive steps to find other revenue streams or leverage their current site visitors to optimize revenue. Times like this are when revenue leaders save jobs and companies.

For more information, schedule a time to talk with an Admiral VRM revenue expert today.

/Case%20Studies/Factinate-recovery-graph.png?width=600&name=Factinate-recovery-graph.png)

/Case%20Studies/Britannica_donations_1_600p.png?width=600&name=Britannica_donations_1_600p.png)